What are banking rules, and how do they work?

Banking rules let you define and set transaction and invoice reconciliation rules for all your connected online portals, custom company profiles, and banking accounts in your GetMyInvoices account. This allows your GetMyInvoices account to automatically reconcile banking transactions that match invoices you’ve already imported, as well as ignore certain transactions like duplicate charges or void transactions and prevent them from being reconciled with your invoices.

Get started with banking rules by following these steps.

Auto Assign: Automatically reconcile transactions and invoices

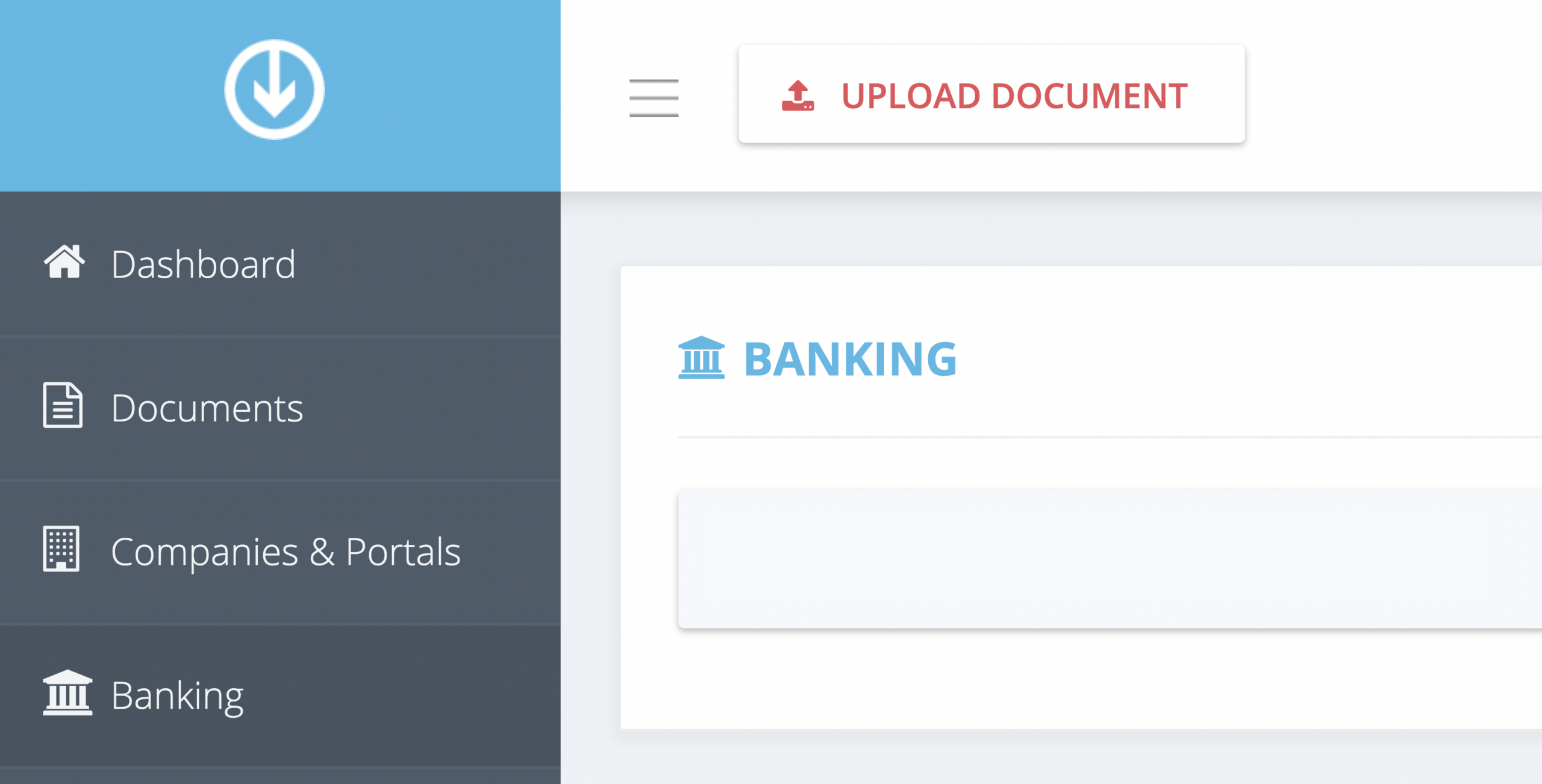

Step 1. From the GetMyInvoices dashboard, click Banking on the left-side menu.

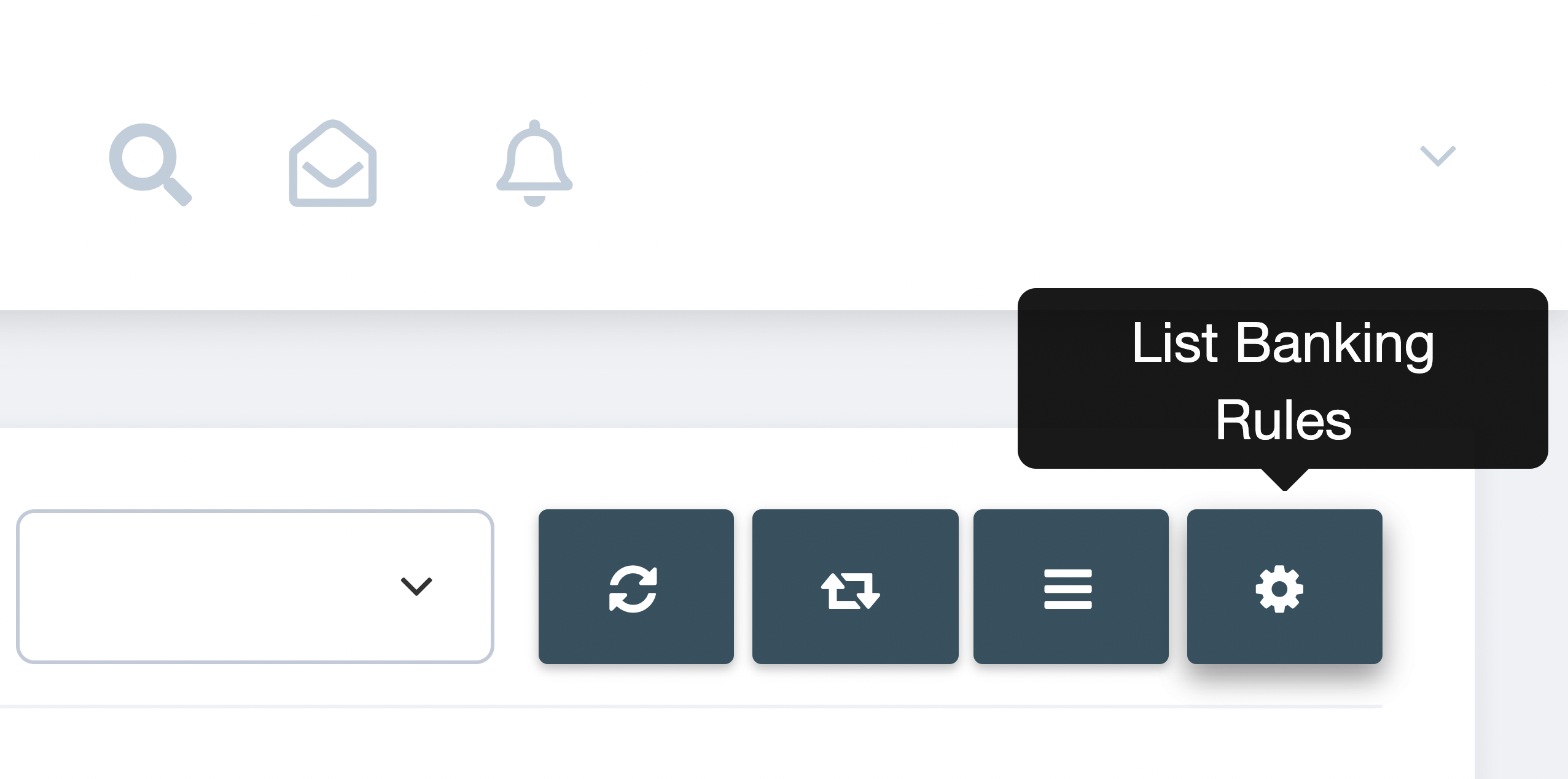

Step 2. Click List Banking Rules (gear button) on the upper right corner of the Banking page.

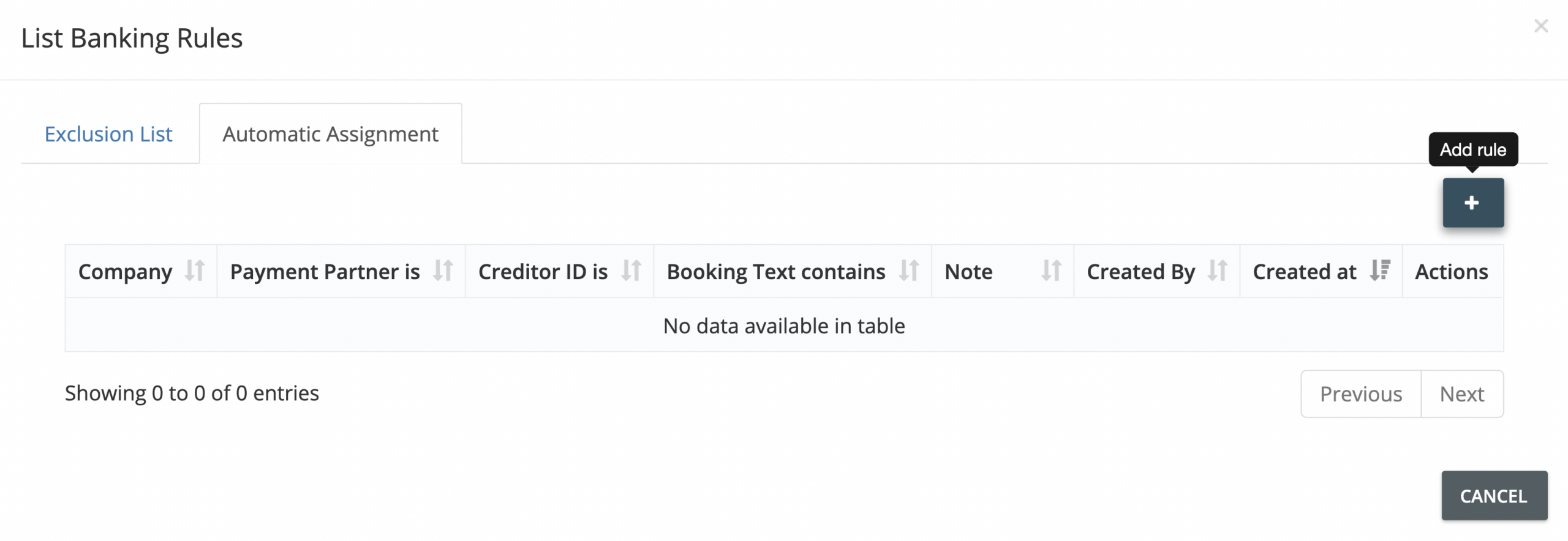

Step 3. On the pop-up window that appears, click the Automatic Assignment tab. Then click Add Rule (plus button).

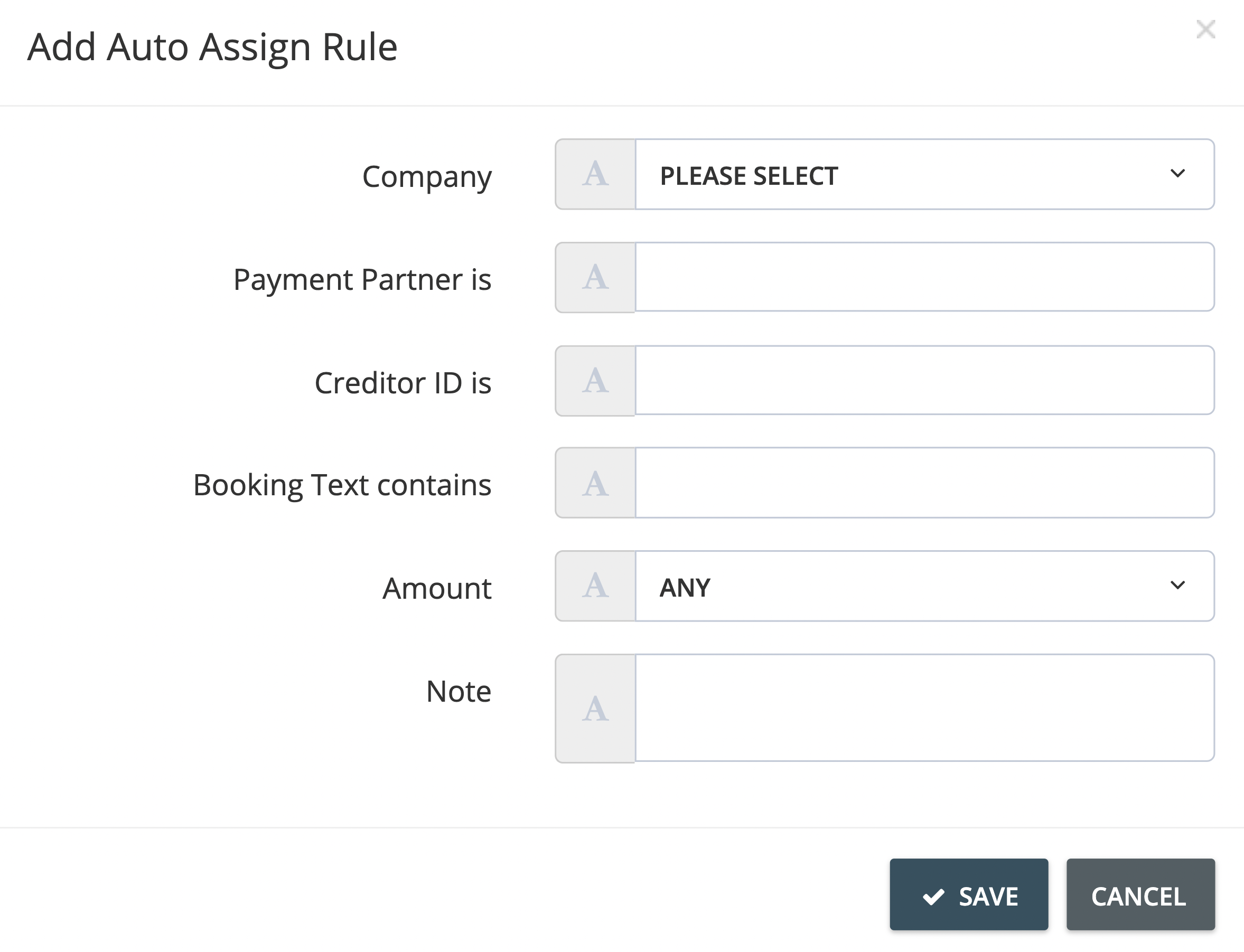

Step 4. Define your automatic assignment rule by filling out the required information in the Add Auto Assign Rule window.

Step 5. Click Save to add the automatic assignment rule. The rule will take effect in your next invoice import run.

Exclusion List: Ignore certain transactions

Step 1. From the GetMyInvoices dashboard, click Banking on the left-side menu.

Step 2. Click List Banking Rules (gear button) on the upper right corner of the Banking page.

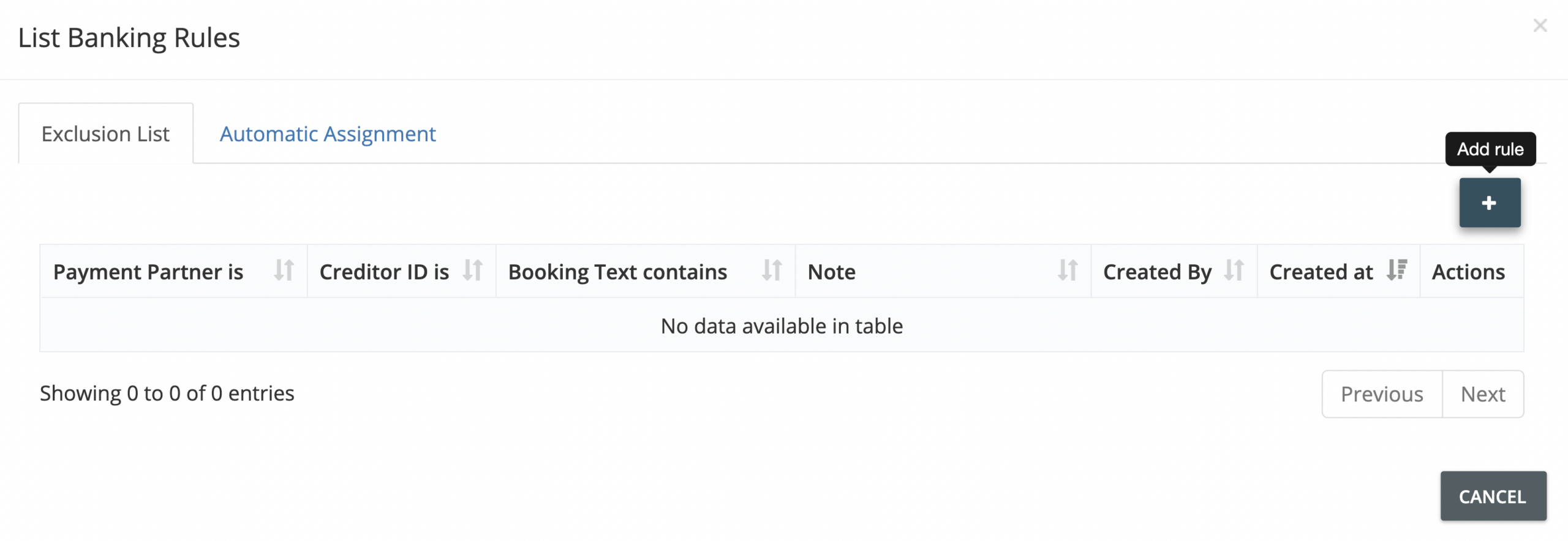

Step 3. On the pop-up window that appears, click the Exclusion List tab. Then click Add Rule (plus button).

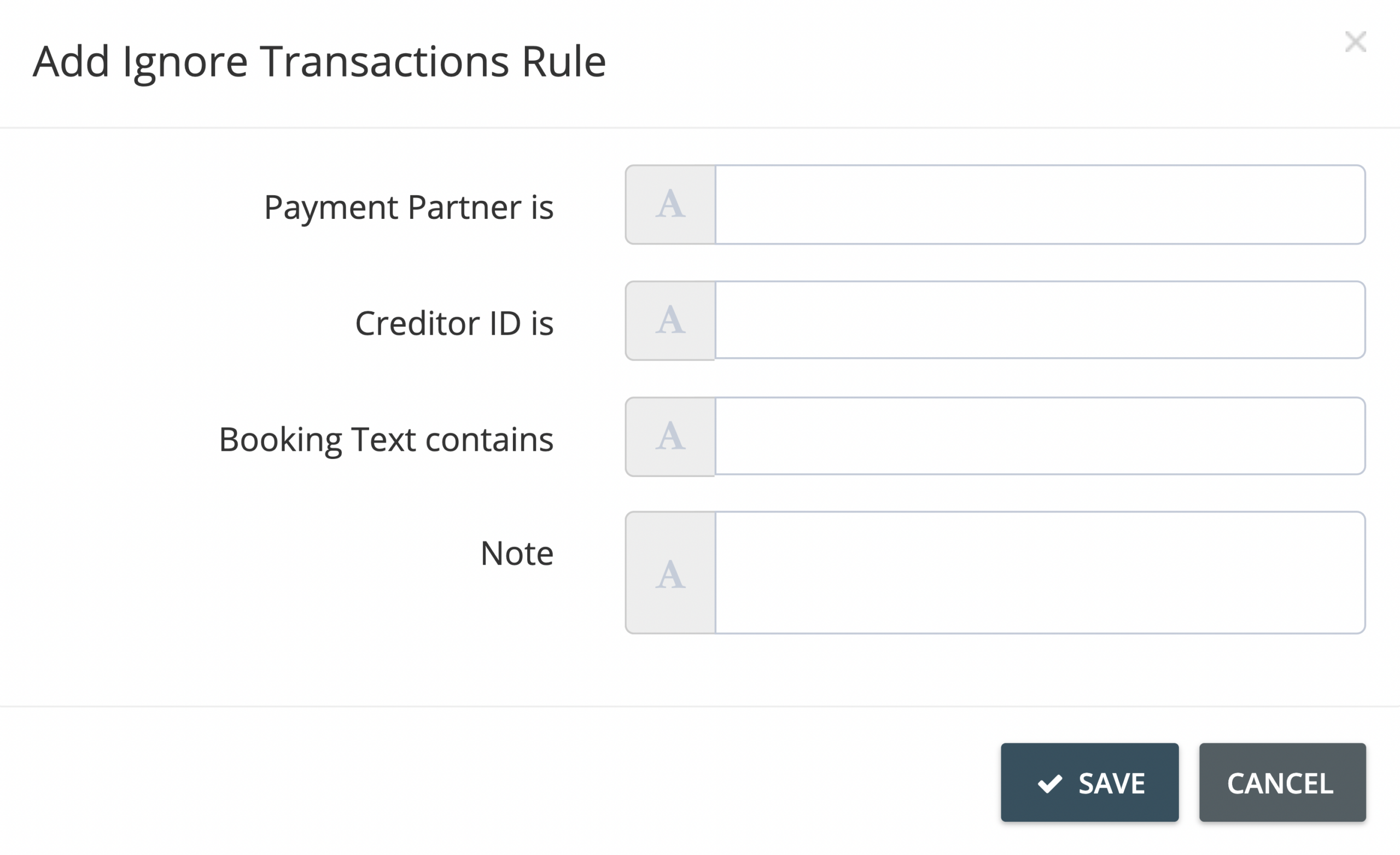

Step 4. Define your exclusion rule by filling out the required information in the Add Ignore Transactions Rule window.

Step 5. Click Save to add the exclusion rule. The rule will take effect in your next invoice import run.